Cost Of Donated Items For Tax Purposes . By turbotax• 25• updated 5 months ago. Internal revenue service (irs) requires donors to value their items. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. and to get the biggest tax savings, make sure you value your charitable donations correctly. The irs defines fmv as what a consumer would. To help guide you, goodwill. how do i determine the value of donated items? To help guide you, goodwill industries international has compiled a list providing price ranges. Here's what to keep in mind. Internal revenue service (irs) requires donors to value their items. How much can you deduct for the gently used goods you donate to goodwill?

from www.goodwillsouthernaz.org

Here's what to keep in mind. The irs defines fmv as what a consumer would. To help guide you, goodwill industries international has compiled a list providing price ranges. Internal revenue service (irs) requires donors to value their items. and to get the biggest tax savings, make sure you value your charitable donations correctly. how do i determine the value of donated items? How much can you deduct for the gently used goods you donate to goodwill? By turbotax• 25• updated 5 months ago. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill.

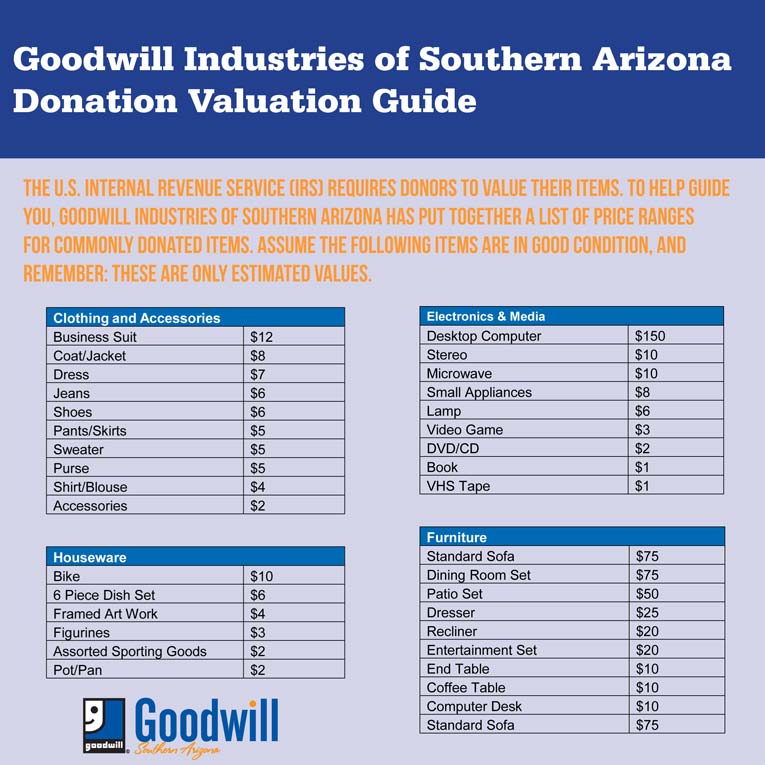

Estimate the Value of Your Donation Goodwill Industries of Southern Arizona

Cost Of Donated Items For Tax Purposes How much can you deduct for the gently used goods you donate to goodwill? The irs defines fmv as what a consumer would. By turbotax• 25• updated 5 months ago. To help guide you, goodwill. Internal revenue service (irs) requires donors to value their items. Here's what to keep in mind. How much can you deduct for the gently used goods you donate to goodwill? Internal revenue service (irs) requires donors to value their items. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. and to get the biggest tax savings, make sure you value your charitable donations correctly. To help guide you, goodwill industries international has compiled a list providing price ranges. how do i determine the value of donated items?

From www.wordtemplatesonline.net

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity) Cost Of Donated Items For Tax Purposes How much can you deduct for the gently used goods you donate to goodwill? By turbotax• 25• updated 5 months ago. Here's what to keep in mind. how do i determine the value of donated items? To help guide you, goodwill industries international has compiled a list providing price ranges. Internal revenue service (irs) requires donors to value their. Cost Of Donated Items For Tax Purposes.

From www.zztongyun.com

How to Create a 501(c)(3) Tax donation in cash 实验室设备网 Cost Of Donated Items For Tax Purposes Here's what to keep in mind. By turbotax• 25• updated 5 months ago. and to get the biggest tax savings, make sure you value your charitable donations correctly. Internal revenue service (irs) requires donors to value their items. how do i determine the value of donated items? the irs uses fair market value (fmv) to establish the. Cost Of Donated Items For Tax Purposes.

From eforms.com

Free Donation Receipt Templates Samples PDF Word eForms Cost Of Donated Items For Tax Purposes the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. To help guide you, goodwill industries international has compiled a list providing price ranges. The irs defines fmv as what a consumer would. Internal revenue service (irs) requires donors to value their items. How much can you deduct for the. Cost Of Donated Items For Tax Purposes.

From www.whitehouseblackshutters.com

Donation Values Guide and Printable white house black shutters Cost Of Donated Items For Tax Purposes How much can you deduct for the gently used goods you donate to goodwill? Here's what to keep in mind. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill. To help guide you, goodwill industries international has compiled a list providing price ranges. Internal revenue service (irs) requires donors to value their items. . Cost Of Donated Items For Tax Purposes.

From www.sampletemplates.com

FREE 20+ Donation Receipt Templates in PDF Google Docs Google Sheets Excel MS Word Cost Of Donated Items For Tax Purposes how do i determine the value of donated items? Internal revenue service (irs) requires donors to value their items. Here's what to keep in mind. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. To help guide you, goodwill. Internal revenue service (irs) requires donors to value their. Cost Of Donated Items For Tax Purposes.

From toughnickel.com

How to Find the Value of Donations for Tax Purposes ToughNickel Cost Of Donated Items For Tax Purposes To help guide you, goodwill. To help guide you, goodwill industries international has compiled a list providing price ranges. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. how do i determine the value of donated items? Internal revenue service (irs) requires donors to value their items. Here's. Cost Of Donated Items For Tax Purposes.

From templatediy.com

Donation Letter for Taxes Sample and Examples [Word] Cost Of Donated Items For Tax Purposes how do i determine the value of donated items? the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. Here's what to keep in mind. How much can you deduct for the gently used goods you donate to goodwill? The irs defines fmv as what a consumer would. Internal. Cost Of Donated Items For Tax Purposes.

From goodwillnne.org

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE Cost Of Donated Items For Tax Purposes and to get the biggest tax savings, make sure you value your charitable donations correctly. By turbotax• 25• updated 5 months ago. To help guide you, goodwill industries international has compiled a list providing price ranges. Here's what to keep in mind. The irs defines fmv as what a consumer would. how do i determine the value of. Cost Of Donated Items For Tax Purposes.

From printablecarilenn.z21.web.core.windows.net

Table Of Values For Donated Clothing Cost Of Donated Items For Tax Purposes How much can you deduct for the gently used goods you donate to goodwill? the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill. The irs defines fmv as what a consumer would. how. Cost Of Donated Items For Tax Purposes.

From www.pinterest.com

If you've donated items you might as well get a tax deduction! Find out how to determine the Cost Of Donated Items For Tax Purposes how do i determine the value of donated items? By turbotax• 25• updated 5 months ago. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. Internal revenue service (irs) requires donors to value their items. Internal revenue service (irs) requires donors to value their items. How much can. Cost Of Donated Items For Tax Purposes.

From www.goodwillsouthernaz.org

Estimate the Value of Your Donation Goodwill Industries of Southern Arizona Cost Of Donated Items For Tax Purposes Internal revenue service (irs) requires donors to value their items. how do i determine the value of donated items? the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. The irs defines fmv as what a consumer would. How much can you deduct for the gently used goods you. Cost Of Donated Items For Tax Purposes.

From lessoncampuswallaba.z21.web.core.windows.net

Donation Value Guide 2022 Cost Of Donated Items For Tax Purposes To help guide you, goodwill industries international has compiled a list providing price ranges. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. and to get the biggest tax savings, make sure you value your charitable donations correctly. To help guide you, goodwill. Internal revenue service (irs) requires. Cost Of Donated Items For Tax Purposes.

From www.pdffiller.com

Irs Donation Value Guide 2023 Fill Online, Printable, Fillable, Blank pdfFiller Cost Of Donated Items For Tax Purposes Internal revenue service (irs) requires donors to value their items. The irs defines fmv as what a consumer would. Here's what to keep in mind. To help guide you, goodwill industries international has compiled a list providing price ranges. By turbotax• 25• updated 5 months ago. Internal revenue service (irs) requires donors to value their items. How much can you. Cost Of Donated Items For Tax Purposes.

From www.pinterest.com

Donation Valuation Guide — Tax Deductions For Donated Goods Tax deductions, Deduction, Tax Cost Of Donated Items For Tax Purposes Internal revenue service (irs) requires donors to value their items. how do i determine the value of donated items? To help guide you, goodwill. To help guide you, goodwill industries international has compiled a list providing price ranges. the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. How. Cost Of Donated Items For Tax Purposes.

From www.sampletemplates.com

FREE 7+ Tax Receipts for Donation in MS Word PDF Cost Of Donated Items For Tax Purposes Internal revenue service (irs) requires donors to value their items. and to get the biggest tax savings, make sure you value your charitable donations correctly. Internal revenue service (irs) requires donors to value their items. By turbotax• 25• updated 5 months ago. How much can you deduct for the gently used goods you donate to goodwill? the irs. Cost Of Donated Items For Tax Purposes.

From yoikiguide.com

Donation Value Guide 2019 Spreadsheet Yoiki Guide Cost Of Donated Items For Tax Purposes the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. By turbotax• 25• updated 5 months ago. Internal revenue service (irs) requires donors to value their items. How much can you deduct for the gently used goods you donate to goodwill? To help guide you, goodwill. Internal revenue service (irs). Cost Of Donated Items For Tax Purposes.

From www.fidelitycharitable.org

9 Ways to Reduce Your Taxable Fidelity Charitable Cost Of Donated Items For Tax Purposes how do i determine the value of donated items? By turbotax• 25• updated 5 months ago. To help guide you, goodwill industries international has compiled a list providing price ranges. Here's what to keep in mind. How much can you deduct for the gently used goods you donate to goodwill? Internal revenue service (irs) requires donors to value their. Cost Of Donated Items For Tax Purposes.

From freedownloads.net

Download 501c3 Donation Receipt Letter for Tax Purposes PDF RTF Word Cost Of Donated Items For Tax Purposes Internal revenue service (irs) requires donors to value their items. how do i determine the value of donated items? and to get the biggest tax savings, make sure you value your charitable donations correctly. To help guide you, goodwill industries international has compiled a list providing price ranges. The irs defines fmv as what a consumer would. By. Cost Of Donated Items For Tax Purposes.